[IFRS 18] New IFRS Accounting Standard to aid analysis of financial performance

May 10, 2024

IFRS 18 will give investors more transparent and comparable information about companies’ financial performance and support better investment decisions. Nick Anderson explains the new standard.

On 9 April 2024, the International Accounting Standards Board (IASB) issued IFRS 18 Presentation and Disclosure in Financial Statements (IFRS 18). All companies that apply IFRS accounting standards around the world are expected to use the new standard. IFRS 18 responds to market demand for greater comparability and transparency in how companies communicate in their financial statements, with a focus on information about financial performance in the statement of profit or loss. The standard ushers in the most significant change to the statement of profit or loss since IFRS Accounting Standards were introduced more than 20 years ago.

IFRS 18 introduces three sets of new requirements, comprising:

- two new defined subtotals in the statement of profit or loss;

- disclosures about management-defined performance measures (MPMs); and

- enhanced guidance on grouping of information in the financial statements.

Together, these requirements will help companies better communicate their financial performance, in turn helping investors make better decisions.

Subtotals in the statement of profit or loss

IFRS 18 improves the comparability of information in the statement of profit or loss by introducing:

* three new defined categories – operating, investing and financing; and

* two new required subtotals to enable analysis – ‘operating profit’ and ‘profit before financing and income taxes’.

These new requirements respond to investors’ concerns about challenges in comparing companies’ financial performance. Today, companies’ statements of profit or loss vary considerably in content and structure. Operating profit is one of the most frequently used subtotals, but companies apply various definitions to this same subtotal because, until now, it has not been defined in IFRS Accounting Standards. To illustrate, in a sample of 100 companies, 61 presented operating profit using at least nine different definitions.

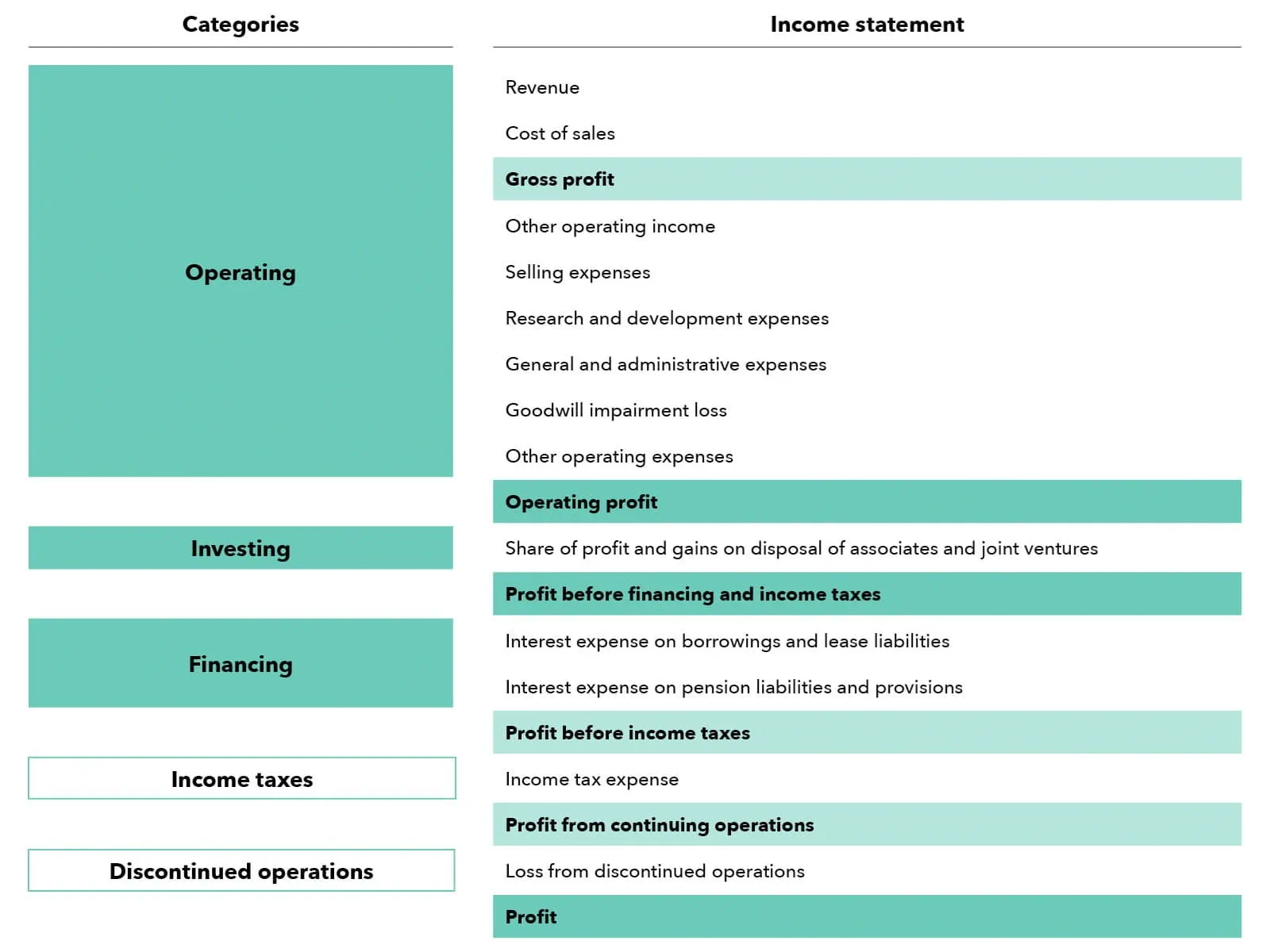

The structure of the statement of profit or loss set out in IFRS 18 requires companies to consistently classify their income and expenses as operating, investing or financing. These requirements are illustrated below for a company that predominantly presents its operating expenses by function. The subtotals highlighted in dark teal are required by IFRS 18 and the subtotals in light teal are additional subtotals that are presented to provide a useful structured summary of the company’s income and expenses.

The operating category, together with the ‘operating profit or loss’ subtotal:

* consists of all income and expenses not classified in the other categories;

* provides a complete picture of a company’s operations; and

* serves as a starting point for forecasting future cash flows.

The investing category:

* includes income and expenses from stand-alone investments – for example, rentals from an investment property or dividends from shares in other companies;

* also includes income and expenses from cash and cash equivalents and shares of profits or losses from equity-accounted associates and joint ventures; and

* enables investors to analyse returns from these investments separately from a company’s operations.

The financing category, together with the ‘profit before financing and income taxes’ subtotal:

* includes income and expenses on financing liabilities such as bank loans and bonds;

* also includes interest expenses on any other liability – for example, lease and pension liabilities; and

* allows investors to analyse the performance of a company before the effects of its financing.

IFRS 18 also includes specific requirements to ensure that, for all companies, operating profit includes the income and expenses from a company’s main business activities. These requirements will mean that for some companies, such as banks and insurers, some income and expenses that would otherwise be classified in the investing or financing categories will be classified in the operating category.

Management-defined performance measures

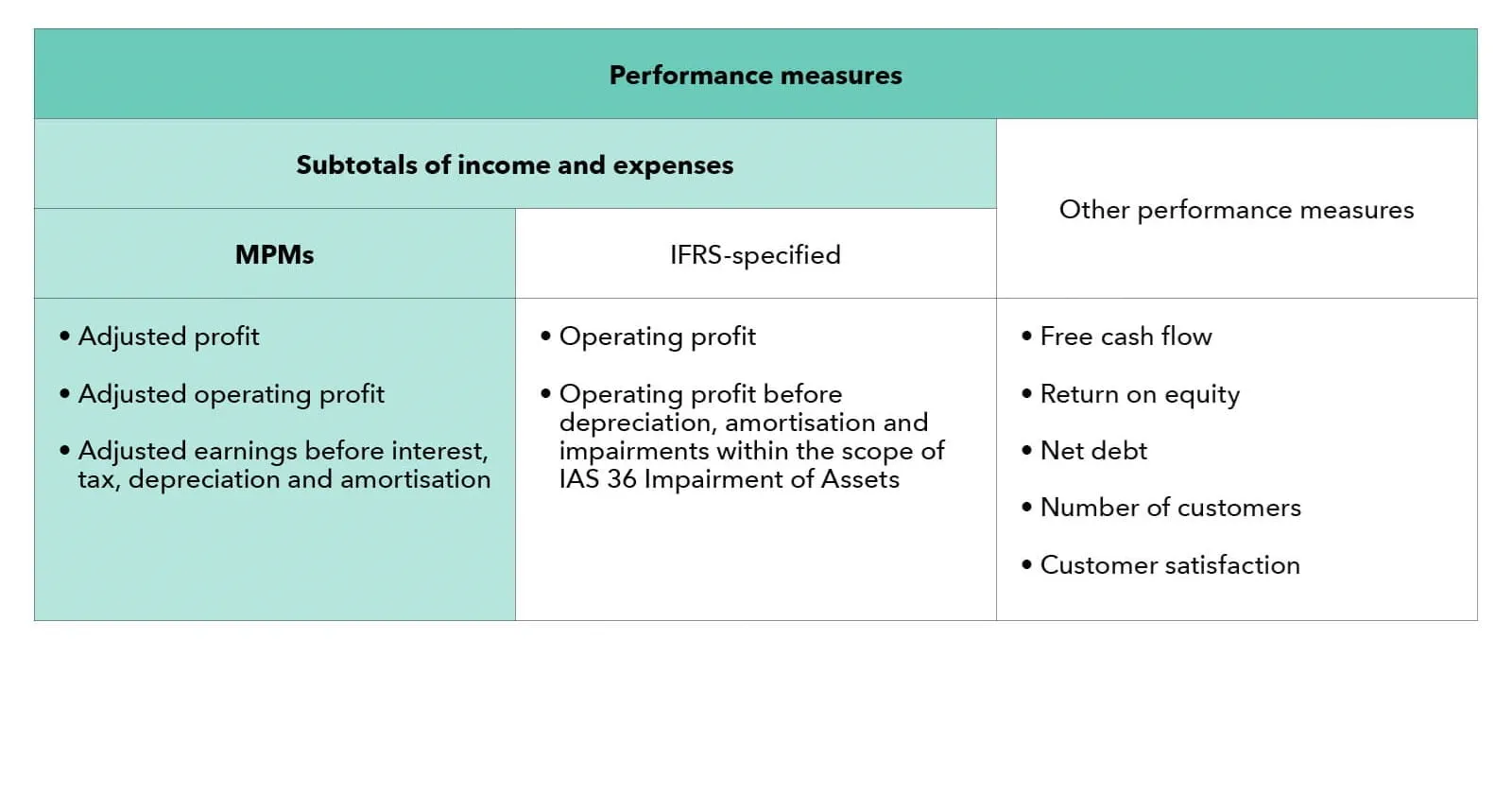

Companies often provide company-specific measures, commonly referred to as alternative performance measures or non-GAAP measures. IFRS 18 requires companies to disclose certain company-specific measures related to the statement of profit or loss in the notes to their audited financial statements – along with accompanying explanations and reconciliations. These requirements will bring transparency and discipline to how companies use measures in the scope of the requirements.

Not all company-specific measures will be required to be disclosed in the financial statements – only those measures that meet the definition of MPMs will be disclosed. MPMs are company-specific measures, included in a company’s public communications outside financial statements, that communicate management’s view of the company’s performance. Furthermore, IFRS 18 limits the MPMs to subtotals of income and expenses not required by IFRS Accounting Standards, as illustrated in the diagram below:

IFRS corporate financial reporting By All Accounts

Companies will be required to disclose information about MPMs in a single note. A crucial aspect of the disclosures is that each MPM will be required to be reconciled to the most directly comparable subtotal or total defined in IFRS Accounting Standards (for example, operating profit). These reconciliations will increase investors’ understanding of how MPMs compare with measures defined by IFRS Accounting Standards. Companies will also be required to disclose explanations of why each MPM is reported and how it is calculated. And, to further improve discipline in the disclosure of MPMs, companies will need to explain any changes to reported MPMs.

Preparers and investors tell the IASB they welcome the disclosure requirements for MPMs – preparers because they can provide their view of performance in the financial statements and investors because they expect greater transparency about management’s view.

Grouping of information

Finally, IFRS 18 introduces enhanced guidance on grouping information in the financial statements, otherwise known as aggregation and disaggregation. Companies will be required to reconsider how they group information in the financial statements, specifically:

* whether information should be presented in the primary financial statements (to provide useful structured summaries of income, expenses, assets, liabilities, equity and cash flows) or disclosed in the notes (if material);

* how to label items meaningfully and to disclose information about items labelled as ‘other’; and

* how to present or disclose operating expenses by nature or by function.

These requirements respond to investors’ concerns that the way companies group information in financial statements does not always provide the information investors need for their analysis – for example, some information is not shown in enough detail while other information is obscured with too much detail.

Next steps

IFRS 18 replaces IAS 1 Presentation of Financial Statements and is effective from 1 January 2027, with the option for companies to apply IFRS 18 early. Financial reporting teams can start preparing now by:

* training colleagues, including senior management, on the requirements of IFRS 18;

* considering necessary changes to internal processes for preparing the financial statements and information systems; and

* thinking about how reported information will change and how to communicate these changes to internal and external parties (including strategically thinking about what company-specific measures related to the statement of profit or loss will be used in public communications).

These efforts will pay off by giving investors more transparent and comparable information about companies’ financial performance, supporting better investment decisions. It is time to prepare for exciting changes in financial reporting.

[Author: Nick Anderson, International Accounting Standards Board Member]

[ICEAW.com]