Updated timeline of income tax notices released by income tax department;

Know why and when you may get a tax notice

Oct 25, 2024

Synopsis

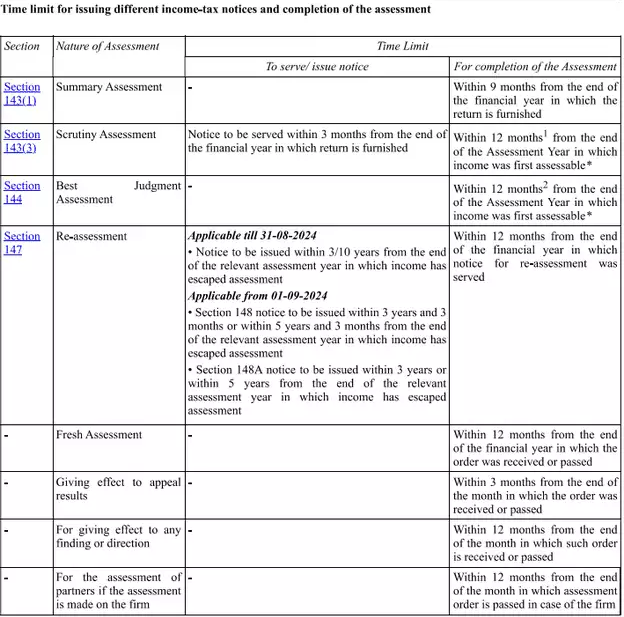

Income Tax Notice: The Income Tax Department has specified when, how and why can you get an income tax notice. A chart has been released by the tax department specifying some of the important sections and time limits about when such a notice can be sent. Read below to find out what the income tax department has said about sending tax notices.

When, How and Why can you get an income tax notice

The timeline for receiving income tax notices has been updated this year, and many taxpayers are eager to find the revised list of these timelines. The Income Tax Department has issued a new tax chart that outlines the time limits for sending different income tax notices. This chart also specifies the sections under which each notice may be issued if tax provisions are violated. Read on to discover how, why, and when you might receive an income tax notice.

What did the income tax department say about sending tax notices

Here are the time limits and types of assessments related to various income tax notices you might receive if found in violation of different tax regulations.:

Section 143 (1)- Summary Assessment: “For completion of the assessment it must be done within 9 months from the end of the financial year in which the return is furnished,” said the tax department. This means that for the income earned in financial year 2023-24 for which the ITR is furnished in 2024-25, the deadline for receiving this notice will be 31 December 2025.”

“A summary assessment intimation notice under section 143(1) is issued to a taxpayer when the tax department has finished processing the submitted income tax return (ITR). In this intimation notice, you can check the tax calculations submitted by you through the ITR and the calculations accepted by the tax department. If you have any tax refund due then the amount of this refund will be mentioned in this intimation notice,” says Mihir Tanna, Associate Director- direct tax, S.K Patodia & Associates LLP, a CA firm.

Section 143(3)-Scrutiny Assessment: “This notice is to be served within 3 months from the end of the financial year in which return is furnished. For completion of assessment under this section it is to be done within 12 months from the end of the Assessment Year in which income was first assessable. For the purpose of completion of assessment in case of an updated return, the time limit of 12 months shall be counted from the end of the financial year in which the updated return is furnished,” said the Income Tax Department. In the above case, the deadline for sending notice will be June 30, 2025 and the deadline for completing the assessment will be March 31, 2026.

"The Income Tax Department has a twin role, enforcement of lax law and service to taxpayers. As part of the latter prior to digital era, IT Department used to issue in press on due dates for filing returns, due dates for payadvance tax etc.,. Now in the digital era department is utilising all channels including department 's own website to disseminate timelines for compliances as taxpayer services," says Ramakrishnan Srinivasan, former chief commissioner of income tax.

A Scrutiny Assessment notice under section 143(3) is issued if the tax department has found any evidence a suspicious reporting in your submitted ITR. “As per the guidelines framed by the tax department every year (such as high risk categories), a certain percentage of the tax returns filed are picked up for scrutiny assessment. For greater efficiency and accountability, the scrutiny assessment is conducted in a faceless manner. The taxpayer receives a notice on email and the same is also visible in his e-filing account under the tab ‘e-proceedings’. The assessee is required to submit responses to the notices issued by the officer with his explanations and necessary documentary evidence. If the tax officer does not agree with any aspect of the computation filed by the assessee, he is required to issue a show-cause notice to the assessee. Finally, the assessment concludes with passing of assessment order under section 143(3) wherein return of income may be accepted or there may be additions to the income or denial of deductions claimed etc,” says Mumbai-based chartered accountant Janhavi Pandit.

Section 144- Best Judgement Assessment: “This notice is issued within 12 months from the end of the Assessment Year in which the income was first assessable,” said the tax department. In above case, the deadline for this notice will March 31, 2026.

This notice is issued when the tax department does not find your answer or reply to queries sent under section 143(3) scrutiny assessment notice as satisfactory. “If you could not answer the queries raised by the tax department to their satisfaction, the tax department will pass an best judgement assessment order where your tax liability is assessed based on the evidence and to the best of the ability of the tax department,” says Tanna.

Section 147- Reassessment: The time limit to issue this notice is divided into two parts:

Applicable till 31-08-2024: Notice to be issued within 3 or 10 years from the end of the relevant assessment year in which the income has escaped assessment. For cases with escaped tax amount up to Rs 50 lakh the deadline is 3 years and for cases above Rs 50 lakh the deadline is 10 years.

Applicable from 01-09-2024: Section 148 notice to be issued within 3 years and 3 months or within 5 years and 3 months from the end of the relevant assessment year in which income has escaped assessment. Section 148A notice to be issued within 3 years or within 5 years from the end of the relevant assessment year in which income has escaped assessment.

The tax department said: “The re-assessment must be completed within 12 months from the end of the financial year in which notice for reassessment was served.”

Mumbai based Chartered Accountant Aniket Kulkarni says, "The section is triggered when any income chargeable to tax has escaped assessment. In such case, the Assessing Officer has power to recompute the income or loss of the assessee. It is important to note that this section gives power to tax officer to initiate proceedings under this section, even if summary assessment or scrutiny assessment as explained above has been previously performed in the case of the same assessee. Generally, the re-assessment is initiated when the tax officer has certain information leading to him forming an opinion that income of the assessee has escaped income. The income tax act has incorporated detailed safeguards and procedures that no every situation is inquired by the tax officer to reopen the cases of the assessee. The information sourced by the income tax department from various sources acts as a feeder for reassessment mechanism such as information obtained tax treaties or through SFT (specified financial transactions) reported by financial institutions."

Kulkarni explains with an example. "Assuming Mr. A has purchased high value immovable properties worth in a financial year (information obtained through SFT and sub-registrar office). However, he has not filed a ITR for that year or has filed a ITR disclosing very little income. So, the suspicion is raised in the mind of tax officer as to how he can fund the purchase of immovable property of substantial amount, what is the source of these funds? Is there any income which has not been disclosed and not assessed?"

"A section 148A notice is also to be issued by the tax department offering you a chance to explain the circumstances and case and why a proceeding should not be initiated against you,” says Tanna.

Income Tax Notice Timeline

Source: Income Tax Department

Fresh Assessment: The tax department said that the fresh assessment of any submitted ITR is to be completed within 12 months from the end of the financial year in which the order was received or passed.

“A fresh assessment order can be issued due to various reasons. For example: if after the processing of the ITR, the tax officer finds any relevant information which warrants a fresh assessment, he may do so. Another case is when CIT (Appeals) or ITAT orders the income tax department to do a fresh assessment for any particular ITR,” says Tanna.

Giving effect to appeal results: The tax department has said the impact on appeal results must be given within three months from the end of the month the order was received or passed.

“Usually when an appeal’s judgement is passed the tax department on a suo moto basis has to give its effect. In the past we have filed a letter with the jurisdictional AO attaching a copy of the favourable order and requesting him to give its effect to the taxpayer,” says Tanna.

For giving effect to any finding or direction: The tax department said that the time limit by which effect to any finding or direction has to be given is within 12 months from the end of the month in which such order is received or passed.

“A higher time limit is given for this effect as it relates to any specific finding or direction. For example, the CIT (Appeals) may ask the tax department to produce a particular evidence for a proceeding, so the tax department needs to find this specifically asked for evidence and produce it before CIT (Appeals),” says Tanna.

For the assessment of partners if the assessment is made on the firm: The tax department said that the assessment must be completed within 12 months from the end of the month in which the assessment order is passed in the case of the firm.

[ET Wealth]