Budget changes: Will capitals gains make you ineligible for tax rebate?

New Delhi, Feb 21, 2025

Pre-Budget 2025, taxpayers could claim the rebate if their total income was Rs 7 lakh or below. However, with the new Budget, this limit has been increased to Rs 12 lakh

For many taxpayers, the Section 87A rebate under the Income Tax Act has been a valuable relief, reducing the overall tax liability, especially for those with an income of Rs 7 lakh or less. However, the Union Budget 2025 has introduced significant changes that could affect how you claim this rebate.

What’s Changed in Budget 2025?

The most notable change is the increase in the income threshold for claiming the rebate. Pre-Budget 2025, taxpayers could claim the rebate if their total income was Rs 7 lakh or below. However, with the new Budget, this limit has been increased to Rs 12 lakh, which is great news for many taxpayers. This means more people will be eligible to receive the tax rebate of up to Rs 60,000.

But, there’s a catch: The rebate will no longer apply to special income—such as capital gains—that is subject to tax at special rates. In simpler terms, if your total income includes capital gains, the rebate won’t apply to that portion of your income.

How Does This Work in Practice?

Ritika Nayyar, Partner, Singhania & Co, simplifies this for you:

Example 1: Total Income Rs 12 lakh, No Special Income

Imagine you have a total income of Rs 12 lakh for the year. This could be a combination of your salary and other normal income sources. Under the old system, you would have been eligible for a Rs 25,000 rebate if your income was below Rs 7 lakh, but now, with the new budget, you can claim a rebate of up to Rs 60,000 because the limit has increased to Rs 12 lakh. This means you pay less tax, which is a positive change.

Example 2: Total Income Rs 12 Lakh with Rs 2 Lakh in Capital Gains

Now, let’s assume your total income is Rs 12 lakh, but Rs 2 lakh of that comes from long-term capital gains, which are subject to special tax rates. In this case, the capital gains portion won’t be eligible for the rebate, as it's taxed at special rates.

So, if your normal income is Rs 10 lakh (after excluding the Rs 2 lakh capital gains), you can claim a rebate on that amount, reducing your tax liability for the normal income. However, the Rs 2 lakh in capital gains will be taxed separately, and the rebate won’t apply to this amount. Therefore, the overall tax you owe will still be lower, but you’ll have to pay tax on the capital gains separately, which is a key change.

Example 3: Total Income Rs 13 Lakh with Rs 3 Lakh in Capital Gains

What if your total income crosses the Rs 12 lakh threshold, and you also have some capital gains? For instance, with a total income of Rs 13 lakh, of which Rs 3 lakh is from capital gains, you would not be entitled to any rebate. Even though your normal income could have been eligible for a rebate under the old system, the total income now exceeds the threshold of Rs 12 lakh, disqualifying you from the rebate.

"In essence if the intent of law was to actually provide relief, despite of excluding the special income, there ought to be relaxation that for claiming the rebate the normal total income excluding capital gains should be below Rs 12 lakh limit. Since the above approach does not seem prudent for taxpayers or be the intent of law to just snatch away the whole benefit just because you have an element of special income in it," said Singhania.

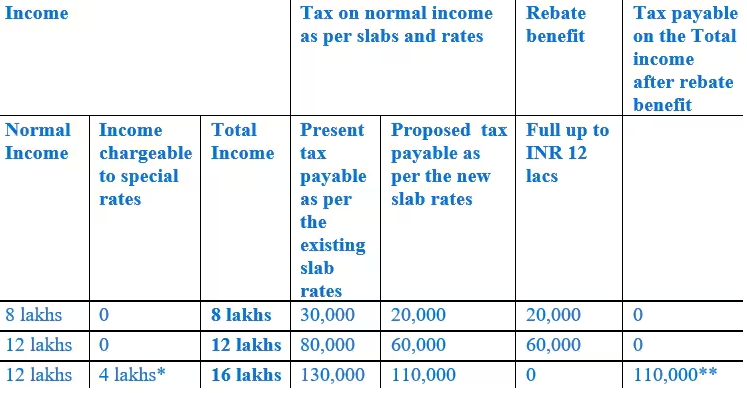

SR Patnaik, Partner (head - taxation), Cyril Amarchand Mangaldas, breaks this down further:

*Assuming long term capital gains tax payable @12.5% amounting to Rs 50,000.

** Exclusive of applicable surcharge and education cess

"Hence, assuming that the proposed changes to the IT Act are passed as is, the rebate provisions shall be available only in respect of the income tax computed on the normal income. However, if the total income of the taxpayer exceeds the minimum threshold limit, then the taxpayer shall be liable to pay on the total income without being entitled to the rebate available under section 87A, as being demonstrated in the above table," said Patnaik.

This shows how important it is to consider both the total income and the components of your income when planning your taxes. If your capital gains push your income over the threshold, you’ll lose the benefit of the Section 87A rebate.

Should You Be Concerned?

If you’re someone who relies on the Section 87A rebate to reduce your tax burden, these changes could impact you, especially if your income includes significant capital gains. While the increase in the income limit to Rs 12 lakh is a welcome change, the exclusion of special income from the rebate may feel like a disadvantage, particularly if your total income barely crosses the threshold due to capital gains.

In essence, the budget’s intent is to simplify and clarify the rules, but it does make it slightly more complicated for those with mixed income sources. To fully benefit from the rebate, you’ll need to ensure that your normal income (excluding capital gains) remains under Rs 12 lakh.

What Can You Do?

Taxpayers with mixed income, especially capital gains, should start reviewing their income sources more carefully. If your income is close to the threshold, consider tax planning strategies to minimize capital gains or adjust other aspects of your income to ensure eligibility for the rebate.

"For taxpayers having total income below Rs 5 Lakhs in the old regime or Rs 7 Lakhs in the new regime, rebate u/s 87A is available to the extent of 100% of the tax payable (for FY 2025-26 onwards, the said limit is Rs 12 Lakhs under the new regime). While the said section does not provide for any exceptions to the kind of income that may be considered for computing the rebate, Section 112A, which provides for the tax liability on long term capital gains arising out of sale of listed equity shares as well as equity-oriented schemes of mutual funds, states that rebate u/s 87A shall not be available on the tax liability arising thereon.

Accordingly, it can be concluded that rebate shall be applicable all kinds of income including long term capital gains on sale of capital assets other than listed equity shares or equity-oriented mutual funds," said Rajarshi Dasgupta, Executive Director-Tax, AQUILAW.

[The Business Standard]