Structured Finance

[Submitted by CA. Vibhuti Gupta,

Chartered Accountant,

New Delhi]

April 7, 2008

"Structured finance" is a broad term used to describe a sector of finance that was created to help transfer risk using complex legal and corporate entities.

Structure

Securitization

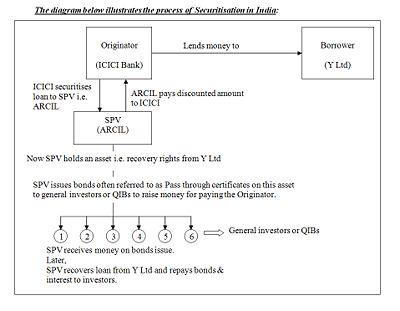

Securitization is a structured finance process, which involves pooling and repackaging of cash-flow producing financial assets into securities that are then sold to investors. The name "securitization" is derived from the fact that the forms of financial instruments used to obtain funds from the investors are securities.

All assets can be securitized so long as they are associated with cash flow. Hence, the securities, which are the outcome of securitization processes, are termed asset-backed securities (ABS). From this perspective, securitization could also be defined as a financial processes leading to an emission of ABS.

Securitization often utilizes a special purpose vehicle (SPV) (alternatively known as a special purpose entity [SPE] or special purpose company [SPC]) in order to reduce the risk of bankruptcy and thereby obtain lower interest rates from potential lenders. A credit derivative is also generally used to change the credit quality of the underlying portfolio so that it will be acceptable to the final investors.

A securitization transaction

Pooling and transfer

The originator initially owns the assets engaged in the deal. This is typically a company looking to raise capital, restructure debt or otherwise adjust its finances. For example, a company may provide 10 bn nominal value of leases, and it will receive a cash flow over the next five years from these. It cannot demand early repayment on the leases and so cannot get its money back early if required. If it could sell the rights to the cash flows from the leases to someone else, it could transform that income stream into a lump sum today (in effect, receiving today the present value of a future cash flow).

A suitably large portfolio of assets is "pooled" and sold to a special purpose vehicle (the issuer), a tax-exempt company or trust formed for the specific purpose of funding the assets. Once the assets are transferred to the issuer, there is normally no recourse to the originator. The issuer is "bankruptcy remote," meaning that if the originator goes into bankruptcy, the assets of the issuer will not be distributed to the creditors of the originator

Issuance

To be able to buy the assets from the originator, the issuer SPV issues tradable securities to fund the purchase. Investors purchase the securities, either through a private offering (targeting institutional investors) or on the open market. The performance of the securities is then directly linked to the performance of the assets. The securities can be issued with either a fixed interest rate or a floating rate. Fixed rate Asset Backing Securities set the "coupon" (rate) at the time of issuance, in the manner similar to corporate bonds. Floating rate securities may be backed by both amortizing and non - amortizing assets. In contrast to fixed rate securities, the rates on "floaters" will periodically adjust up or down according to a designated index. The floating rate usually reflects the movement in the index plus an additional fixed margin to cover the added risk

Credit enhancement and tranching

Securities generated in a securitization deal are "credit enhanced," meaning their credit quality is increased above that of the originator's unsecured debt or underlying asset pool. This increases the likelihood that the investors will receive cash flows to which they are entitled, and thus causes the securities to have a higher credit rating than the originator.

Individual securities are often split into tranches, or categorized into varying degrees of subordination. Each tranche has a different level of credit protection or risk exposure than another: there is generally a senior class of securities and one or more junior subordinated classes that function as protective layers for the senior class. The senior classes have first claim on the cash that the SPV receives, and the more junior classes only start receiving repayment after the more senior classes have repaid.. In the event that the underlying asset pool becomes insufficient to make payments on the securities (e.g. when loans default within a portfolio of loan claims), the loss is absorbed first by the subordinated tranches, and the upper-level tranches remain unaffected until the losses exceed the entire amount of the subordinated tranches. The senior securities are typically AAA rated, signifying a lower risk, while the lower-credit quality subordinated classes receive a lower credit rating, signifying a higher risk.

The most junior class (often called the equity class) is the most exposed to payment risk. In some cases, this is a special type of instrument which is retained by the originator as a potential profit flow. In some cases the equity class receives no coupon (either fixed or floating), but only the residual cash flow (if any) after all the other classes have been paid.

There may also be a special class which absorbs early repayments in the underlying assets. This is often the case where the underlying assets are mortgages which, in essence, are repaid every time the property is sold. Since any early repayment is passed on to this class, it means the other investors have a more predictable cash flow.

Servicing

A servicer collects payments and monitors the assets that are the crux of the structured financial deal. The servicer can often be the originator, because the servicer needs very similar expertise as the originator and would want to ensure that loan repayments are paid to the Special Purpose Vehicle.

Repayment structures

Most securitizations are amortized, meaning that the principal amount borrowed is paid back gradually over the specified term of the loan, rather than in one lump sum at the maturity of the loan

Structures are as follows :

A controlled amortization structure is a method of providing investors with a more predictable repayment schedule, even though the underlying assets may be non - amortizing. After a predetermined "revolving" period, during which only interest payments are made, these securitizations attempt to return principal to investors in a series of defined periodic payments, usually within a year. An early amortization event is the risk of the debt being retired early

A controlled amortization structure is a method of providing investors with a more predictable repayment schedule, even though the underlying assets may be non - amortizing. After a predetermined "revolving" period, during which only interest payments are made, these securitizations attempt to return principal to investors in a series of defined periodic payments, usually within a year. An early amortization event is the risk of the debt being retired early.

On the other hand, bullet or slug structures return the principal to investors in a single payment. The most common bullet structure is called the soft bullet, meaning that the final bullet payment is not guaranteed on the expected maturity date; however, the majority of these securitizations are paid on time. The second type of bullet structure is the hard bullet, which guarantees that the principal will be paid on the expected maturity date. Hard bullet structures are less common for two reasons: investors are comfortable with soft bullet structures, and they are reluctant to accept the lower yields of hard bullet securities in exchange for a guarantee.

Types

There are several main types of structured finance instruments.

-

Asset-backed securities (ABS) are bonds or notes based on pools of assets, or collateralized by the cash flows from a specified pool of underlying assets.

-

Mortgage-backed securities (MBS) are asset-backed securities whose cash flows are backed by the principal and interest payments of a set of mortgage loans.

-

Collateralized debt obligations (CDOs) consolidate a group of fixed income assets such as high-yield debt or asset-backed securities into a pool, which is then divided into various tranches.

-

Collateralized mortgage obligations (CMOs) are CDOs backed primarily by mortgages.

-

Collateralized bond obligations (CBOs) are CDOs backed primarily by corporate bonds.

-

Collateralized loan obligations (CLOs) are CDOs backed primarily by leveraged bank loans.

-

Credit derivatives are contracts to transfer the risk of the total return on a credit asset falling below an agreed level, without transfer of the underlying asset.