Explained: Tax implications of income earned from shares, mutual funds

New Delhi, June 26, 2023

The tax implications of income earned from shares, mutual funds and ETFs (Exchange Traded Funds) largely depend on the type of investment, the holding period and the amount of profit earned

Union Budget 2023 changed the way mutual funds are taxed in India. Investors should be aware of the revised regulations to effectively plan their investments and understand the tax liabilities associated with them.

One of the notable changes pertains to the long-term capital gains on Specified Mutual Funds. Previously, investors enjoyed the benefit of indexation while calculating these gains. However, under the new provisions, this indexation benefit will no longer be available for specified mutual funds that invest less than 35% of their proceeds in the equity shares of domestic companies.

"This means that investors will now need to calculate their long-term capital gains without factoring in indexation," said Aditya Chopra, Managing Partner, Victoriam Legalis - Advocates & Solicitors.

Furthermore, debt mutual funds will now be taxed based on the applicable slab rates. "This implies that the tax on income from debt-oriented mutual funds will be determined by the individual's income tax bracket. It is essential for investors to consider this change and understand the impact it may have on their overall tax liability," said Chopra.

Moreover, tax implications of income earned from shares, mutual funds and ETFs (Exchange Traded Funds) largely depend on the type of investment, the holding period and the amount of profit earned. Short-term capital gains (STCG) for equity shares are taxed at 15%, while long-term capital gains (LTCG) are taxed at 10% after the exemption upto Rs.1 lakh on aggregate LTCG in a financial year.

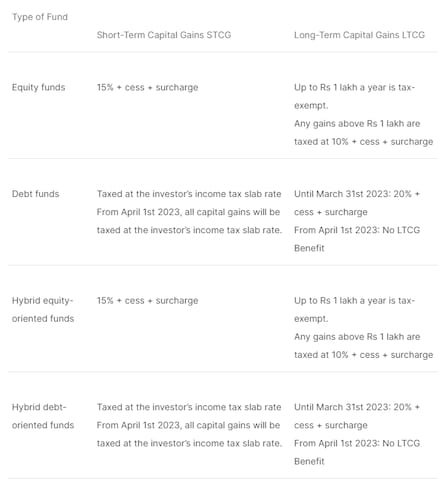

Tax varies depending on type of MF you are investing in

To understand the taxation on mutual funds comprehensively, investors should consider the factors that influence the taxes levied. Firstly, there are two types of mutual funds: debt-oriented and equity-oriented. The tax treatment differs based on the type of fund. Moreover, dividends received from mutual fund investments are also subject to taxation.

What is capital gains

When investors sell their capital assets (mutual fund units) at a higher price than the initial investment, the resulting profit is termed as capital gains and is subject to taxation. The holding period of the investment also plays a crucial role in determining the tax rate applicable to capital gains. According to Indian income tax regulations, longer holding periods result in lower tax amounts. Therefore, investors who hold their mutual fund investments for an extended period will be liable to pay a comparatively lower tax on their capital gains.

Dividends vs capital gains

Returns in mutual funds can be earned through dividends and capital gains. "Dividends are a portion of the profit distributed among investors by mutual fund houses. They are paid when companies have surplus cash to share with their investors. On the other hand, capital gains are realized when the selling price of the mutual fund units exceeds the purchase price. Both dividends and capital gains are taxable in the hands of mutual fund investors", explained Chopra.

Taxation of Dividends Offered by Mutual Funds

As per the amendments made in the Union Budget 2020, dividends offered by any mutual fund scheme to investors are added to their taxable income and taxed at their respective income tax slab rates.

Previously, dividends were tax-free in the hands of investors as the companies paid dividend distribution tax (DDT) before paying dividends.

Understanding short-term capital gains tax

Short-term capital gains (STCG) arise when equity shares listed on a stock exchange are sold within 12 months of purchase. These gains are taxable at a rate of 15%.

For instance, X purchased 100 shares of a company for Rs.500 per share and sold them within 6 months for Rs.600 per share. The calculation of STCG would be as follows - Sale price = 100 shares x Rs.600 = Rs.60,000, Expenses on Sale (brokerage) = Rs.500, Purchase price = 100 shares x Rs.500 = Rs.50,000, Short-term capital gain = Sale price - Expenses on Sale - Purchase price = Rs.60,000 - Rs.500 - Rs.50,000 = Rs.9,500.

Understanding long-term capital gains tax

On the other hand, long-term capital gains (LTCG) occur when equity shares are sold after holding them for more than 12 months.

Prior to the introduction of the Budget 2018, LTCG from equity shares and equity-oriented mutual funds were tax-exempt. However, the revised provisions state that if a seller makes a long-term capital gain of over Rs.1 lakh on the sale of such investments, a tax rate of 10% (plus applicable cess) is applicable, without the benefit of indexation, explained Chopra.

Consider X who purchased shares for Rs.100 and sold them for Rs.120, with the stock value being Rs.110 as of 31st January 2018. Out of the capital gains of Rs.20, Rs.10 is taxable as LTCG at 10% without indexation. These new provisions are effective from 1st April 2018.

Equity MF treated the same as equity shares

"Equity mutual funds are treated the same as equity shares from a taxation standpoint, so STCG are taxed at 15% for equity mutual fund units held for 12 months or less and LTCG are taxed at 10%, if the holding period exceeds 12 months, on cumulative capital gains over Rs. 1 lakh for a financial year," said Vipul Jai, Partner,PSL Advocates & Solicitors

Debt funds vs Equity MFs

The tax rates and holding period for Debt Funds are quite different from equity Mutual Funds. In the case of Debt Mutual Funds, STCG are gains derived from units held for 3 years or less and LTCG apply to units held for more than 3 years which are taxed as per applicable Income Tax slab rate of the investor and 20% with indexation respectively.

According to Jai, India has four types of ETFs in India – Index, Sectoral, Gold and International. LTCG and STCG on Index and Sectoral ETFs are taxed at 15% and 10% (on aggregate gains exceeding Rs.1 lakh in a Financial Year) respectively, similar to equity mutual funds. Whereas for Gold and International ETFS, if the holding period is less than 36 months, STCG are taxed as per income tax slab rate of the investor and LTCG is taxed at 20% with indexation for holding period exceeding 36 months.

Capital Gain Tax on Hybrid Funds

Capital gain on Hybrid Mutual Funds depends on the asset allocation of such a fund. If the hybrid fund is equity oriented then the tax treatment is the same as of equity mutual funds.

"Similarly, hybrid funds are debt oriented then the tax treatment is the same as debt mutual funds. If the fund invests more than 65% of its corpus in equity and equity related securities then it is an equity oriented fund. Otherwise, it is a debt oriented fund," according to Scripbox, a digital wealth manager.

How does Budget 2023 impact my tax implications if I redeem my mutual funds?

Suppose X invested in a specified mutual fund that falls under the new provisions of Budget 2023. After holding the investment for five years, he decided to sell his mutual fund units at a profit. Previously, he would have been able to calculate his long-term capital gains by considering the benefit of indexation. However, under the revised regulations, X must now calculate his capital gains without the indexation benefit. Additionally, the tax on his capital gains will depend on his income tax slab rate, as debt mutual funds are now subject to applicable slab rates.

Tax on mutual fund redemption, explained by Scripbox

Securitiestransaction tax

Apart from the taxes mentioned above, all equity-oriented funds also incur a securities transaction tax of 0.001 per cent at the time of redemption. Investors receive the fund after STT deduction, so you do not have to pay it separately.

SIP taxation

Tax on systematic investment plans is calculated for each individual unit. The holding period from the date of purchase to the redemption date determines whether it will be considered for short-term or long-term capital gains tax. If redemption is carried out in parts, then the first-in, first-out rule is applied, meaning that the first units purchased are considered sold first.

For example, if you decided to redeem your investment after 12 months of SIP payments, all of your gains would not be free of tax. Only the gains earned on the first SIP will be tax-free as only that investment would have completed one year. The rest of the gains will be subject to short-term capital gains tax.

Can mutual fund investments help me get a rebate on income tax?

Under Section 80C of the Income Tax Act, tax benefits are applicable in the case of ELSS or Equity Linked Saving Schemes. You can get up to Rs.1.5 lakh in tax deduction and save around Rs.46,800 each year on taxes. However, ELSS has a minimum lock-in period of three years.

Any short-term capital loss from the sale of equity shares can be offset against short-term or long-term capital gains, and if not fully set off, can be carried forward for eight years. Similarly, long-term capital losses can now be carried forward and set off against any other long-term capital gains, but not short-term gains, said Chopra.

Why pick MFs over FDs?

" Investing in fixed deposits is a great disadvantage, particularly if you fall under the highest income tax bracket, as the interest is added to your taxable income and taxed at your income tax slab rate. This is where mutual funds score better. When you invest in a mutual fund, you get the benefit of expert money management and tax-efficient returns," said ClearTax.

Are mutual fund taxes payable every year?

If you opt for a mutual fund scheme, you need to pay the applicable taxes only when you redeem the units or sell the scheme. It does not count on every year. However, your total income for the financial year in question includes your dividend income from mutual fund schemes. So, you need to pay tax for this dividend income if your income is liable to income tax, said ClearTax.

[The Business Standard]